Credit in developing countries can be granted through formal or informal channels. Formal channels include institutions such as banks, credit cooperatives, and government agencies. Loans of this type accrue positive interest and are typically court enforced. Informal credit channels include relatives, friends, community members, moneylenders, rotating savings and credit associations, and informal intermediaries. Loans such as these may or may not accrue positive interest. Loans of either type may be used by the borrower for consumption or investment in a business.In 1930s rural China, informal credit was sometimes court enforced. However, it was more often self-enforcing, especially in remote areas. With a positive–interest rate loan, the borrower would pay principal and interest. With a zero–interest rate loan, the borrower would repay the principal and provide some non-monetary resource in lieu of interest. For example, the borrower might have supplied land, labor, or draft animal services to the lender.

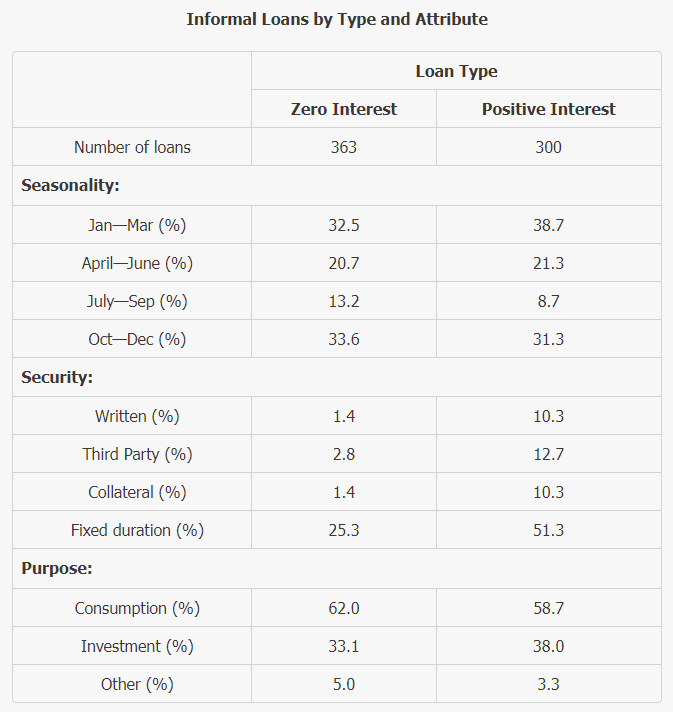

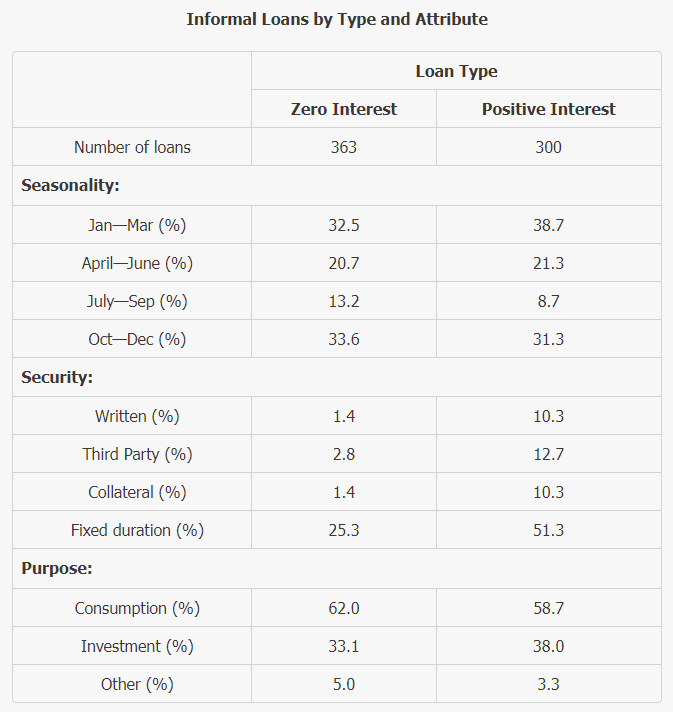

The table shows data from a comprehensive survey, conducted in 1936, of all households in 21 villages in what is now northeast China. It includes all loans reported as occurring during 1935. A loan involves security if and only if it involves a written (as opposed to a verbal) contract, the presence of a third-party guarantor, or collateral. Loans of fixed duration involve a well-defined repayment period.

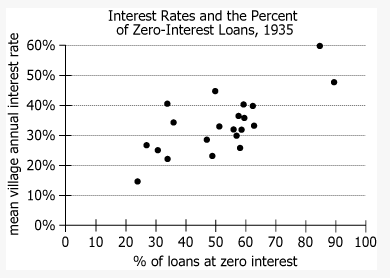

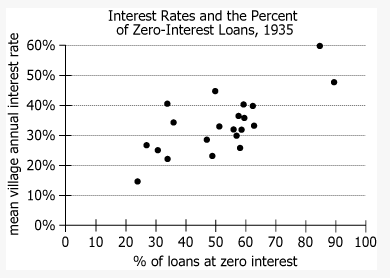

For the loans presented in the table, the graph shows the relationship between the average (arithmetic mean) annual interest rate by village and the percent of loan contracts that were negotiated at zero interest.

mofa留学圈

mofa留学圈

做题笔记

做题笔记

暂无做题笔记

暂无做题笔记 提交我的解析

提交我的解析